Founded in 1999, Ortholine is a company specializing in the distribution of consumables for orthodontic practitioners.

Ortholine offers more than 5,000 product references required for orthodontic treatments (brackets, wires, arches, adhesives, etc.):

- Third-party brands

- Private label products

Entry date: october 2025

Revenues: -

Transaction type: MBO (primary)

“We are delighted to welcome Momentum Invest alongside us. Their entrepreneurial DNA, responsiveness, and strong expertise in distribution businesses quickly convinced us. Their support will enable us to strengthen our organization and accelerate our growth.”

Gary and Ruth Sztanke, founders Ortholine

Founded in 1928, Mathieu Pharma is a company specializing in the design and distribution of parapharmacy products. The company markets 1,500 products across more than 15 product ranges:

- Own brands

- Third-party brands

Entry date: june 2025

Revenues: 10 millions euros

Transaction type: MBI (primary)

“We are delighted to embark on this new phase of recovery alongside Momentum Invest. Their unwavering commitment, entrepreneurial approach, and confidence in our project have been decisive factors. Momentum Invest has established itself as the partner of choice to support our development ambitions: strengthening our regional presence, diversifying our offering, and implementing a targeted external growth strategy.”

Thomas Roucher and Romain Gay-Depassier, Managers Mathieu Pharma

QYYP is a group offering managed IT and telecoms solutions, supporting digital transformation and information systems management for French microbusinesses, SMEs, and local authorities:

- IT service contracts

- IT equipment and infrastructure integration

- Telecoms

- Operator subsidiary

Entry date: may 2025

Revenues: 25 millions euros

Transaction type: MBO (primary)

“We are delighted to welcome Momentum Invest on board. Their industry knowledge, pragmatic approach, and active involvement in our strategic thinking make them a trusted partner. Their support will enable us to accelerate our transformation towards a high value-added IT services model and actively pursue our external growth strategy.”

Geoffroy Dubois, CEO QYYP

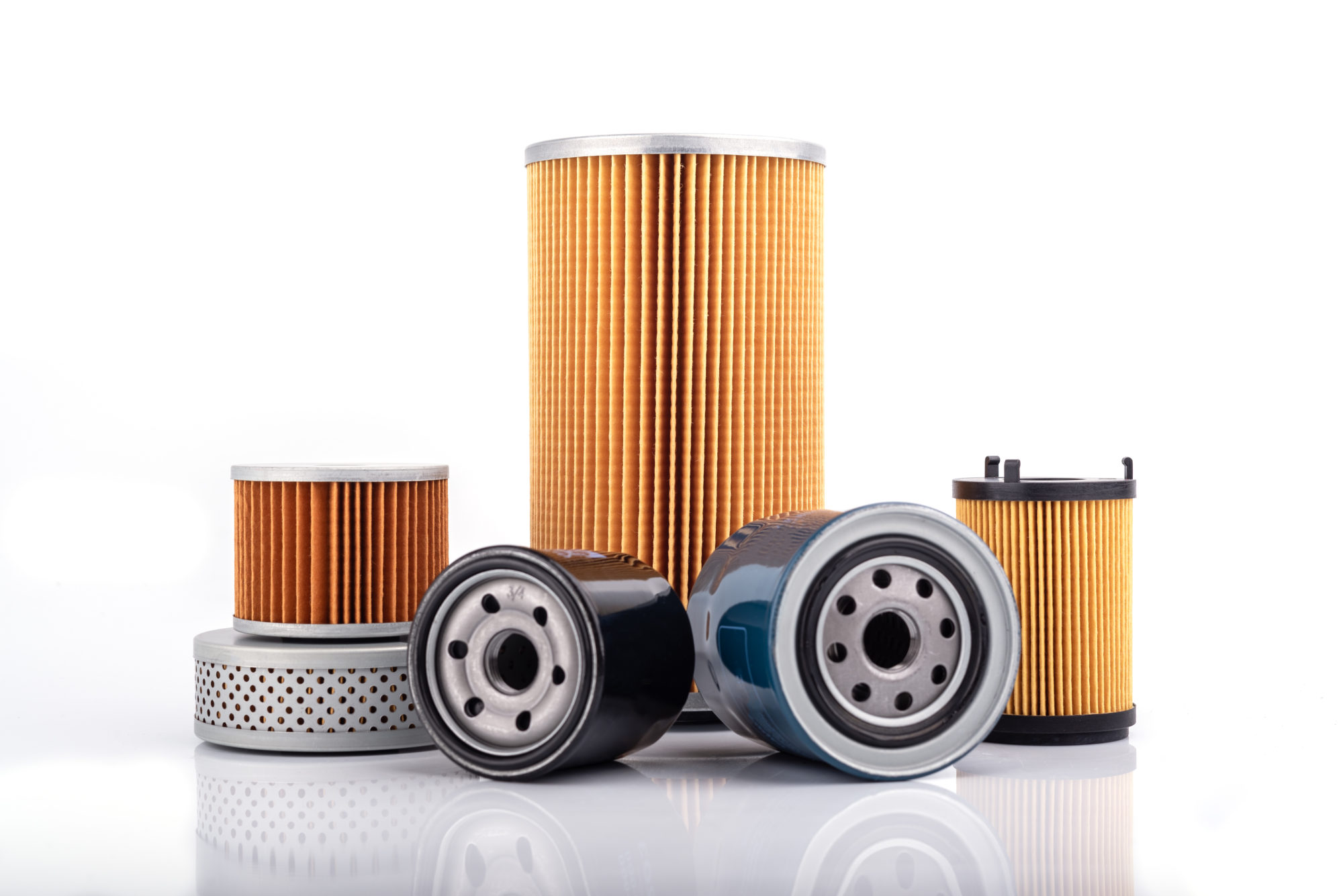

Akore is a company specializing in the design, import and distribution of spare parts, mainly :

- Filters

- Rubber products (hoses)

- Accessories

Entry date: june 2024

Revenues: 20 millions euros

Transaction type: MBO (primary)

“We are delighted to announce that Momentum Invest has joined Akore. Thanks to its in-depth knowledge of the spare parts market, its involvement and the contribution of one of their sector experts, Momentum Invest has established itself as the ideal partner to accelerate Akore’s growth and pursue its development.”

Laurent Escubedo, Chairman-founder Akore

Agriland is specialized in the distillation and extraction of natural ingredients for the flavours & fragrances market and for the food industry:

- Rosemary essential oil

- Rosemary antioxydant

- Lycopene

Entry date: june 2024

Revenues: -

Transaction type: MBO

“We are delighted and honored to welcome TAG Partners, Momentum Invest and Cèdre as our new majority shareholders. With their support, we are giving ourselves the means to achieve our ambition of becoming a major player in natural ingredients in France and internationally.”

Saif Kacem and Ayet Hlaim, Managing Directors Agriland

Creacard is a major player in the distribution of prepaid and reloadable payment cards, under the PCS brand, through a network of 35,000 physical outlets and its mobile application. The company offers many services:

- 4 cards adapted to different types of customer needs;

- Physical and online payment;

- Bank transfers;

- Direct debit;

- RIB/IBAN;

- …

Entry date: october 2022

Revenues: -

Transaction type: LBO

INFOCERT is a pioneer in software certification for publishers and companies that have developed internal software.

The company offers the following certifications:

- NF 525 (mandatory): cash register software with regard to the VAT anti-fraud law;

- NF 552: software with regard to the processing of personal data (RGPD);

- NF 203: IT accounting software (purchases, sales, stocks, etc.) and digital safe-deposit box.

Entry date: may 2022

Revenues: -

Transaction type: MBI (primary)

“Thanks to its expertise in the TIC sector, Momentum Invest quickly understood our company’s strategic, regulatory and operational challenges. Their support and their ecosystem will be valuable in structuring our growth.

We are very happy to begin this new phase with their support, alongside Capital Croissance.”

Bruno Saurel and Françoise Gimenez, Shareholder managers Infocert

Created in 2019, Splashr is a digital marketing company with 3 offers:

- Splashr : Snack content video platform (Facebook, Instagram, TikTok, Snapchat, …)

- Sparkle : Creative agency specialized on TikTok (#1 in France)

- bl0x : NFT/Crypto growth marketing agency 3.0

Entry date: february 2022 (exit)

Revenues: 10 million euros

Transaction type: OBO (primary)

« We are very pleased that Momentum Invest enters Splashr’s capital, alongside us and the company’s key executives.

Thanks to its excellent knowledge of our market and its real capacity of operational support, Momentum Invest appeared to us as the ideal committed partner to support and structure our strong growth. »

Franck Carasso, Jérémy Bendayan et Mickaël Tordjman, Co-founders Splashr

Created in 2004, Generik is specialized in the design and online BtoB distribution of hair care products, combining product quality and competitive prices, for hairdressing salons, home hairdressers and students.

The company distributes its products thanks to two distribution channels:

- Online via the e-commerce website www.Generik.fr (majority) and a call center

- Retail via wholesalers

Entry date: february 2022

Revenues: -

Transaction type: MBI (primary)

« We are very pleased that Momentum Invest enters Generik’s capital, alongside us.

Momentum Invest, with its real capacity of operational support, appeared to us as the ideal partner to support Generik’s next development phase. »

Bruno et Delphine Mocher, Founding Managing Directors Generik

Created in 1990, ITC is a French leading e-commerce platform for professional tattoo, piercing and permanent makeup equipment :

- Products and equipment for professionals

- Care/hygiene products

Entry date: april 2021

Revenues: -

Transaction type: LBO (primary)

“Thanks to its caring and constructive approach, Momentum Invest was the ideal partner to support ITC in a new stage of growth. We have been immediately attracted by the team’s experience in managing SMEs, its contribution to strategic thinking and its exceptional ecosystem”.

Jean-Christian André, CEO ITC

Acquired in 2011 by its current CEO, Eddifis Group (ex-PHB) is specialized in “high end” maintenance and renovation work on old buildings:

- Renovation

- Roofing

- Plumbing

- Exterior carpentry

- Painting, decoration, gilding…

Entry date: january 2021

Revenues: 20 million euros

Transaction type: OBO

« The entry of Momentum Invest and Bpifrance marks a key milestone in Eddifis Group’s history.

After a first phase of development initiated in 2019 and the completion of structuring acquisitions in 2018, we now want to accelerate consolidation, mainly in our historical businesses. »

Laurent Vanheerswynghels, CEO Eddifis Group

Created in 1988, EasyVista is a software editor operating in several countries and focused on :

- Service Management

- Customer Support Management (Self-Help)

EasyVista solutions allow automations of information technology services destinated to internal collaborators and clients.

Entry date: september 2020

Revenues: 45 millions euros

Transaction type: PtoP

“We are very happy to welcome Momentum Invest at our capital.

In order to speed up our development and strengthen our position as a leading actor in the ITSM and CSM markets, we are starting a new growth cycle based on our innovation and execution capacities. Momentum Invest appeared as the ideal partner to help us delivering our business plan, alongside Eurazeo PME among others.”

Sylvain Gauthier and Jamal Labed, CEO and COO EasyVista

Created in 2012, Eskimoz is an SEO agency specialized in :

- Natural, mobile, social and video referencing

- Digital PR, e-reputation

- Google penalties, web content

- SEO training

Entry date: november 2019 (exit)

Revenues: -

Transaction type: LBO (primary)

« Momentum Invest is the ideal partner to accompany the transformation of our young company which is experiencing very strong growth.

Thanks to its network and strategic partners, we had already signed the first commercial contracts even before their entry into capital. They are a true partner which brings not only a strategic reflexion, a lot of experience and also a great expertise in many operational subjects. »

Andréa Bensaid, CEO-founder Eskimoz

Created in 2000, Uzik is a digital communication agency specialized in brand experience for major key B2C accounts based around 360° campaigns:

- Live Marketing

- Web & Mobile

- Social Media

- Brand Identity

- Influence

Entry date: July 2019

Revenues: 15 million euros

Transaction type: MBO (primary)

“From our first encounter, we have been allured by Momentum Invest’s team, its great responsiveness and the pragmatic and benevolent approach of its duo. We have immediately identified their very operational added value.

Their understanding of the consulting and digital communication industries convinced us that Momentum Invest is the best partner to support our group in the new stage of its development.”

Gaël Personnaz, CEO UZIK

Created in 2009, Digital Prod is specialized in the design and production of digital advertising contents :

- Social & media campaigns

- E-mailing & CRM

- Video production

- Websites & mobile

Entry date: July 2019 (exit)

Revenues: 10 million euros

Transaction type: LBO (primary)

“Momentum Invest and its partners have continuously shown great responsiveness, efficiency and motivation to support us.

Their pragmatic and operational approach has enabled us to advance at pace on the opening up of our group’s capital.

The network they have put at our disposal has already allowed us to initiate the next phase of our development.”

Régis Josephovitch, CEO-founder Digital Prod

Created in 1984, ABMI is an engineering and industrial innovation consulting firm, with three major expertise:

- Product engineering (designing new products, prototyping and pre-industrialisation tests)

- Engineering process (production processes enhancement)

- Industrial facilities (notably research and design)

Entry date: December 2018 (exit)

Revenues: 45 millions euros

Transaction type: MBO (primary)

“Momentum Invest immediately understood our challenges and key factors of success in the transformation of our organization.

Its partners have already brought us added value notably in terms of human resources, by reinforcing our finance department and supplying suitable executive Board members”

Vincent Coent, CEO ABMI

Created in 1985, Groupe Fitness Park is the French low-cost gym clubs’ leader through its Fitness Park network (200 clubs and 500 000 members):

- Access to large gyms (1 000 to 3 000 sqm)

- High-end equipment (Technogym)

- Open 7 days a week (from 6am to 11pm)

- €29.95/month

Entry date: April 2017

Revenues: 60 millions euros

Transaction type: MBO

“Momentum Invest understands operational challenges related to our young group’s strong growth.

Its partners were notably directly involved with marketing and HR issues, providing extremely appreciated solutions.

Their operational experience, their outstanding ecosystem, in particular in the digital field, and their network offer us real added value”

Philippe Herbette, CEO Fitness Park